A Note From Chris

As we approach Independence Day, I would like to take a moment to reflect on the values and principles that make our nation so extraordinary. The Fourth of July is a time when we come together as a community to commemorate the birth of our great nation and honor the courageous men and women who have served and sacrificed to preserve and protect our liberties.

On this day, we not only celebrate the signing of the Declaration of Independence but also the fundamental ideals it represents – freedom, liberty, and justice for all. These ideals have shaped the very fabric of our society, allowing us to strive for a better future and embrace the diversity that defines us. As a movement, we have the privilege and responsibility to carry these principles forward. Together, we can foster an environment that upholds the values our founding fathers envisioned, where every individual is treated with respect, dignity, and equality.

This Independence Day, as we gather with family and friends to celebrate, let us remember that the spirit of America lies not only in its history but also in the actions we take today. Together, let us continue striving for progress, justice, and unity, keeping the flame of hope alive for generations to come. May you and your family enjoy a day filled with thankfulness and gratitude for living in this great nation of opportunity, promise, and hope.

Sincerely,

Chris Felton

President/CEO

Did You Know?

Peak student loan season has begun and runs through August.

The time is now to market student loans to your members. Take advantage of your partnership with ISL Education Lending and our premier student loan interest rates so your members don't get stuck with high interest rate loans. Remember to direct your members to the student loan section on your website or to your referral brochure so your institution gets credit for every loan disbursed.

Also available through the partnership are ISL Education Lending's free online college planning tools that help students and families plan to pay for college. ISL is more than happy to create additional marketing materials for your institution, including web banner ads or social media posts. Let us know if we can assist further in your marketing of student loans.

Not currently offering student loans to your members? Learn more about the program and how to get started today!

Learn More

Technology Solutions

Keeping up with the ever changing regulatory and cyber landscape.

In our interconnected world, businesses of all sizes face increasing risks from cyber threats and data breaches. These incidents can have serious consequences, such as financial losses and damage to a company's reputation. To combat these risks, more and more credit unions are hiring Virtual Chief Information Security Officers (VCISOs) to strengthen their defenses. Let’s explore why the demand for VCISOs is on the rise and how they help improve cybersecurity.

Facing Bigger Cybersecurity Challenges

As technology advances, so do the challenges of keeping our digital systems safe. Cybercriminals are becoming smarter, making it harder to protect sensitive data and important systems. Traditional security measures are often not enough. That's why companies are turning to VCISOs, who have extensive experience and knowledge. These experts help organizations develop strategies that are customized to their specific needs.

Saving Money with VCISOs

Hiring a full-time Chief Information Security Officer (CISO) can be expensive, especially for smaller businesses. They may not have the resources to support an entire cybersecurity team. VCISOs offer a more cost-effective solution. They provide services as needed, for specific projects or time periods. This flexibility allows companies to access top-tier cybersecurity expertise without the costs associated with a full-time executive position.

A Wide Range of Skills

Managing cybersecurity effectively requires a diverse skill set. VCISOs have a wealth of experience working with different organizations in various industries. They bring knowledge about emerging threats, industry best practices, and regulatory requirements. This helps companies make informed decisions and stay ahead of potential risks.

An Outside Perspective

One of the great benefits of hiring VCISOs is that they offer an unbiased view of cybersecurity matters. Internal security teams may struggle to identify blind spots or assess vulnerabilities without biases. VCISOs, as external consultants, provide fresh insights, conduct impartial evaluations, and implement necessary changes without any conflicts of interest.

Flexibility and Adaptability

The field of cybersecurity is always changing, with new threats appearing regularly. Organizations need to be flexible and adapt their security strategies accordingly. VCISOs excel in providing flexible and adaptable solutions. They are used to working with different clients and staying up to date with the latest industry trends. They can quickly adjust to an organization's changing needs, make necessary changes, and ensure security remains strong against evolving threats.

Compliance and Regulations

Meeting regulatory requirements and industry standards is important for all organizations. VCISOs have in-depth knowledge of compliance frameworks and can assist in developing and implementing effective strategies to meet these standards. They can guide organizations through complex compliance landscapes, conduct audits, and ensure adherence to regulations. This helps mitigate legal and financial risks associated with non-compliance.

In our digital world, credit unions must prioritize cybersecurity to protect their assets and maintain the trust of their members. Virtual Chief Information Security Officers (VCISOs) have become crucial resources for businesses seeking expert guidance in this complex field. With their specialized skills, cost-effective approach, diverse expertise, unbiased perspective, and adaptability, VCISOs can help organizations enhance their cybersecurity and effectively address the growing threats. By hiring VCISOs, companies can proactively safeguard their digital assets, build resilience, and create a secure and trustworthy environment for all stakeholders.

At Think|Stack, we understand finding and retaining a full time CISO who can keep up with the ever changing regulatory and cyber landscape can be a challenge, so we created our virtual CISO offering to provide credit unions and non-profits with a team of individuals to support your cyber leadership needs. Our service provides the oversight, strategic planning, and governance that your technology systems need to lead you into the future. We help you include cyber in the executive team, in the boardroom and with your examiners. We blend tangible deliverables and workshops, with our proven strategy, to help you navigate cyber now and into the future.

Learn More

Employee Benefit Resources

Employee Retention Credit (ERC) assistance for credit unions and business members.

Tax credits are among the most complex areas of the tax code and have gone through significant updates since the start of the pandemic. Adding to the risk and complexity of filing for tax credits is a recent IRS circular raising concerns about promoters attempting to mislead ineligible business owners to file for Employee Retention Credit (ERC) refunds.

InterLutions recently launched a partnership with Innovation Refunds, a proven leader and Fintech in the ERC field, to help credit unions and their business members better understand the complexities of qualifying and filing for ERC.

Through the new partnership, credit unions and their business members now have access to ERC assistance from independent and objective tax experts who are not incentivized to push employers to qualify and file for tax credits. Even if a credit union does not qualify for ERC, or if a credit union has already filed for ERC, they can still deliver a valuable and turn-key ERC consulting solution to their business members that need help with the qualification and filing process.

Contact InterLutions to learn more about ERC Consulting Services.

Contact Us

Financial Services Consulting

Kicking the can down the road.

In the aftermath of the Fed’s 25 basis point rate hike in May, the market consensus rate path eliminated any possibility of additional hikes and indicated a Fed pivot in September with four 25 basis point eases by January 2024. The Fed announced they had shifted to a data driven approach going forward and would adjust policy as needed. However, they repeated their sentiment that it was unlikely they would be lowering rates anytime in 2023 and could push rates higher if warranted. They made no change to their funds target in their June meeting but released a fresh DOT plot showing the majority of voting members expected two rate hikes by year end. Fed Chairman Powell pointed to the continued strength of employment data and sticky inflation numbers to require some additional rate increases to bring inflation down to their 2.00% target. He warned that the Fed expected it will take more time to tame inflation.

The Fed fund futures market shifted back to anticipation of a 25 basis point rate hike ahead. It also erased the four 25 basis point eases priced in the previous month as funds traded at 5.20% for settlement in January 2024. Yields climbed in July with some flattening seen in the curve. The yield curve hints that the market consensus has not changed opinion as much as it has kicked the can down the road. The “higher for longer" mantra from the Fed has been incorporated, but for only a short time. The slight tweak in the yield curve and shift in the Fed funds future’s market imply a Fed pivot early next year, with the four eases coming in 2024.

The consensus rate path is far from certain. On top of everything else in the equation, we will have the Presidential campaign in full swing. Given our current ability to thoughtfully discuss political issues in a calm, civilized manner, the election should be interesting. Our advice remains constant – let your balance sheet steer your path forward rather than any interest rate forecast. Keep liquidity front and center. If “higher for longer” plays out, we will likely see liquidity get worse before it gets better.

Speaking of liquidity, QuantyPhi is excited to now offer a Liquidity Framework Review service to assist credit unions in assessing and strengthening their liquidity risk management program. This service will analyze the robustness and effectiveness of your internal liquidity risk management framework and liquidity measurement and monitoring tools. QuantyPhi will review all your liquidity-related policies, procedures, and monitoring tools and provide recommendations outlining ways in which you can improve your process to better manage your liquidity program, leaving you better prepared to manage emerging liquidity risks. Please contact us if you would like to learn more about how we can help you manage liquidity.

Contact Us

What’s Trending?

Thinking beyond cybersecurity to safeguard member data.

Members are accustomed to the scrutiny required to ensure they are who they say they are, but despite the many security controls credit unions have in place, threats remain. So, how should credit union leaders be thinking about cybersecurity and fraud now, and what types of attacks are most likely to slip through the cracks?

Read the Article

Our Community

Sixth annual Addie’s Angels on Earth donation drive results.

Shannon Cate, Manager Member Services, and her husband Kevin started Addie’s Angels on Earth in 2018 to celebrate and remember their daughter, Addison Marie, who was stillborn on June 3, 2016. The charity organization holds a donation drive every June to collect supplies to donate to a local hospital dealing with infant loss. These supplies are used to provide infant loss boxes and other remembrance items to grieving families who are leaving the hospital with their babies in their hearts, instead of in their arms. In 2022, they also started providing supplies for rainbow bags. These bags go to parents who are welcoming their rainbow babies into the world. A rainbow baby is one born after a loss. This year, they also introduced the opportunity to order an angel or a rainbow bag from Addie's Angels to be mailed directly to grieving families. They are hoping this allows for more people to feel the love from their support network.

In its sixth year, the donation drive raised over $9,000 in donations.

“This is a mission that is near and dear to our hearts. With one in four pregnancies ending in a loss, we know that we cannot stop the heartache of losing a baby for another family, but we can try to ease their pain and suffering and remind them they are not alone.” ~ Kevin and Shannon Cate

Learn How You Can Help

Credit Unions Connect

Stories that exemplify the movement

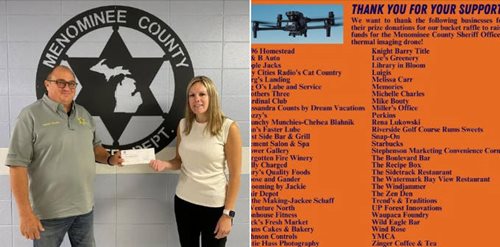

Keeping the community safe.

Integra First Federal Credit Union raised $2,906 for the Menominee County Sheriff's Office to purchase a new thermal imaging drone. This drone equips the police department with advanced capabilities to enhance public safety, improve response times, and aid in critical operations where visibility or access is limited.

Community food drive.

Brokaw Credit Union is excited to serve as the Marathon County sponsor and drop-off location for WAOW-TV9's Food Drive which will be held July 10 – 20. Their employees have already gotten a head-start on donations and look forward to helping support local families.

Read More Credit Union Stories

What’s New and Who’s Who

Kevin Chiappetta elected PCR from the Midwestern US Subregion for the CFA Institute.

.jpg)

We are excited to share that Kevin Chiappetta, CFA, President of QuantyPhi, has been elected as the Presidents Council Representative (PCR) from the Midwestern US Subregion for the esteemed CFA Institute. The CFA Institute is a global association of investment professionals that sets the standard for excellence in the financial industry. The Presidents Council, composed of representatives from various subregions, plays a crucial role in shaping the Institute's policies, promoting ethical practices, and fostering professional development within the industry. Kevin, a highly accomplished professional with a wealth of experience in the finance sector, emerged victorious in a regional election process. His extensive knowledge, leadership skills, and dedication to promoting the highest standards of ethics and professionalism made him an ideal candidate for this prestigious role.

As the PCR from the Midwestern US Subregion, Kevin will serve as a strong voice for the region, advocating for the interests of investment professionals and ensuring that their concerns are represented at the highest level. He will collaborate closely with other council members to contribute to the development of industry-leading standards, policies, and initiatives that drive the advancement of the finance profession. Kevin’s education includes a bachelor's degree in Accounting from St. Norbert College in De Pere, WI. He is a Chartered Financial Analyst (CFA) charter holder and an active member and volunteer for the CFA Institute in Charlottesville, VA. He was elected to the CFA Society Milwaukee Board in July 2019 and elected as President in 2021. He has been an active member of the society for 25+ years. Congratulations, Kevin!

Read the Press Release

Cameron Krueger accepted a full-time position as Marketing Coordinator.

We are excited to announce the promotion of Cameron Krueger from a part-time position to the role of full-time Marketing Coordinator. In this role, Cameron is responsible for creating and scheduling email marketing and social media campaigns while making recommendations for improving key performance indicators (KPIs). He also uses graphic design to create marketing materials to support sales initiatives and promotions. Cameron joined Corporate Central in June 2022 as a Graphic Design Intern with a primary focus on creating effective graphics. In December 2022, Cameron was promoted to a part-time position of Marketing Coordinator where he continued to use his knowledge of graphic design to further enhance the organization’s brand through organizing successful marketing campaigns across email and social media. Cameron graduated from Carthage College in May 2023 with his bachelor's degree in Graphic Design. Congrats, Cameron!

Read the Press Release

Learn More About Our Team